Problem that matters

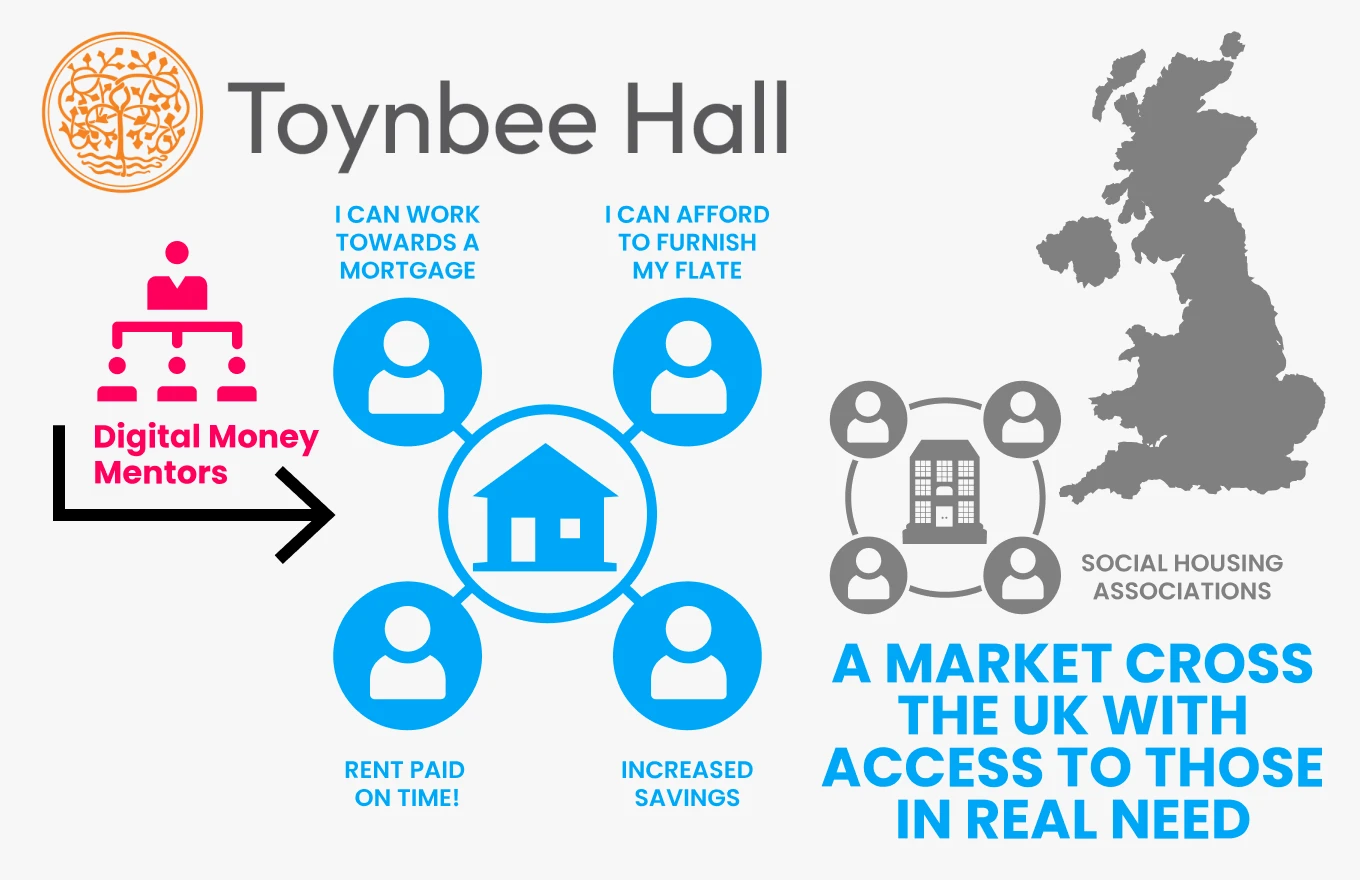

“How do we spread their Financial Literacy programme, Digital Money Mentors, across the UK?”

- 20.3 million low-income people in the UK

- 39% lack confidence in managing money

- Annual poverty premium is £490

- Digital Money Mentors Programme:

- Builds financial confidence

- Helps people learn to use financial services

- Builds savings, reducing risk

Innovative solution

Apply the Social Impact Game for

- Purpose: Clarity about problem to solve – people in poverty need to improve money management

- Plan: Focus on providing solution to specific group and set social impact measures

- People: inspiring practitioners, potential partners and clients to take part based on their purpose

- Practice: test and implement framework with Social Housing Associations (SHA) to spread the service to SHA tenants by

- creating a database of SHAs to identify the market

- interviewed the Money Mentor trainers to develop Marketing Strategy

- designed a Webinar for SHAs to recruit participants

- Performance: developed a framework and pipeline system for clients to use Digital Money Mentors

Making impact happen

- Developed a Customer Journey process for Customer Engagement

- Designed a webinar system

- Projected pipeline value of £7200 in first year with potential to reach 4000 people